can you tax a service fee

The purpose of the state sales tax service fee is to assist. The calibration fee will be taxable even if the seller separates the charge.

First Time Ordering Instacart As A Customer Usually A Shopper Why In The Hell Is There Such A Massive Service Fee And Why Is It More Than The Payout Of Some Batches

Businesses that sell services across.

. Fees for services performed by attorneys or trustees who are salaried members of the Mortgagees staff. Credit Report The veteran can pay for the credit report obtained by the lender. A service fee also known as a vendor fee is a percentage of the sales tax collected that a retailer is allowed to retain in order to cover the expenses incurred by collecting and.

Delaware Hawaii New Mexico and South Dakota tax most services. Credit card surcharges. Tax Service fees are an example of an unallowable charge.

If you did not provide a list or. You can deduct your tax preparation fees whether you pay to prepare your taxes once a year or pay quarterly taxes. An optional payment designated as a tip gratuity or service charge is not subject to tax.

Yet more would likely be due to. Because some employers keep a portion of service charges the IRS considers automatic. Tax service fees exist because lenders want to protect their access to collateral if a borrower defaults.

Some states Ohio for example charge tax on service charges if it is a mandatory fee. Can you tax a service fee. Extensions Tax Service Note.

For example if you go to a restaurant that says they include. You can renew your vehicle registration online 90 days before the expiration date or up to six months. Tax Service Fee Underwriting Fee Verification Fee Employment Deposit etc Warehouse Fee Appraisal Fee Appraisal Fee.

Fees The veteran can pay for recording fees and recording taxes or other charges incident to recordation. Surcharges are legal unless. The second taxable service is fabrication.

Credit card surcharges are optional fees added by a merchant when customers use a credit card to pay at checkout. After all if a borrower isnt paying his property taxes its probably only a. When a service provider bundles internet access with a taxable service such as telecommunications service or cable television service the service provider should not collect.

Fabrication manufacturing is the labor involved in creating tangible. An optional payment designated as a tip gratuity or service charge is not subject to tax. Assuming you were like most winners and chose the cash option a 24 federal tax withholding would reduce the 4973 million by 1194 million.

An optional payment designated as a tip gratuity or service charge is not subject to tax. A mandatory payment designated as a tip gratuity or service charge is included in taxable gross. The service charge is a fee usually 18-22 around the Los Angeles area that is added by the venue or independent catering company to act as an operating cost for things such as.

As you can read from the above tax service fees are not permitted to be. In the rest of the 41 states and the District of Columbia services are not taxed by default but services specified by the state may be taxed. Pay through Direct Debit automatic monthly payments from your checking account also known as a Direct Debit Installment Agreement DDIA.

Still others like Texas and Minnesota are actively expanding service taxability. For example if the lender is charging the Veteran purchaser an Origination Fee of 5 then unallowable fees. Actually I have to disagree.

A mandatory payment designated as a tip gratuity or. Remember you must have a passing vehicle inspection before you can renew. Of course if you do business in more.

The Fees Taxes And Tip Is Almost Equal To The Cost Of The Food Ordered R Mildlyinfuriating

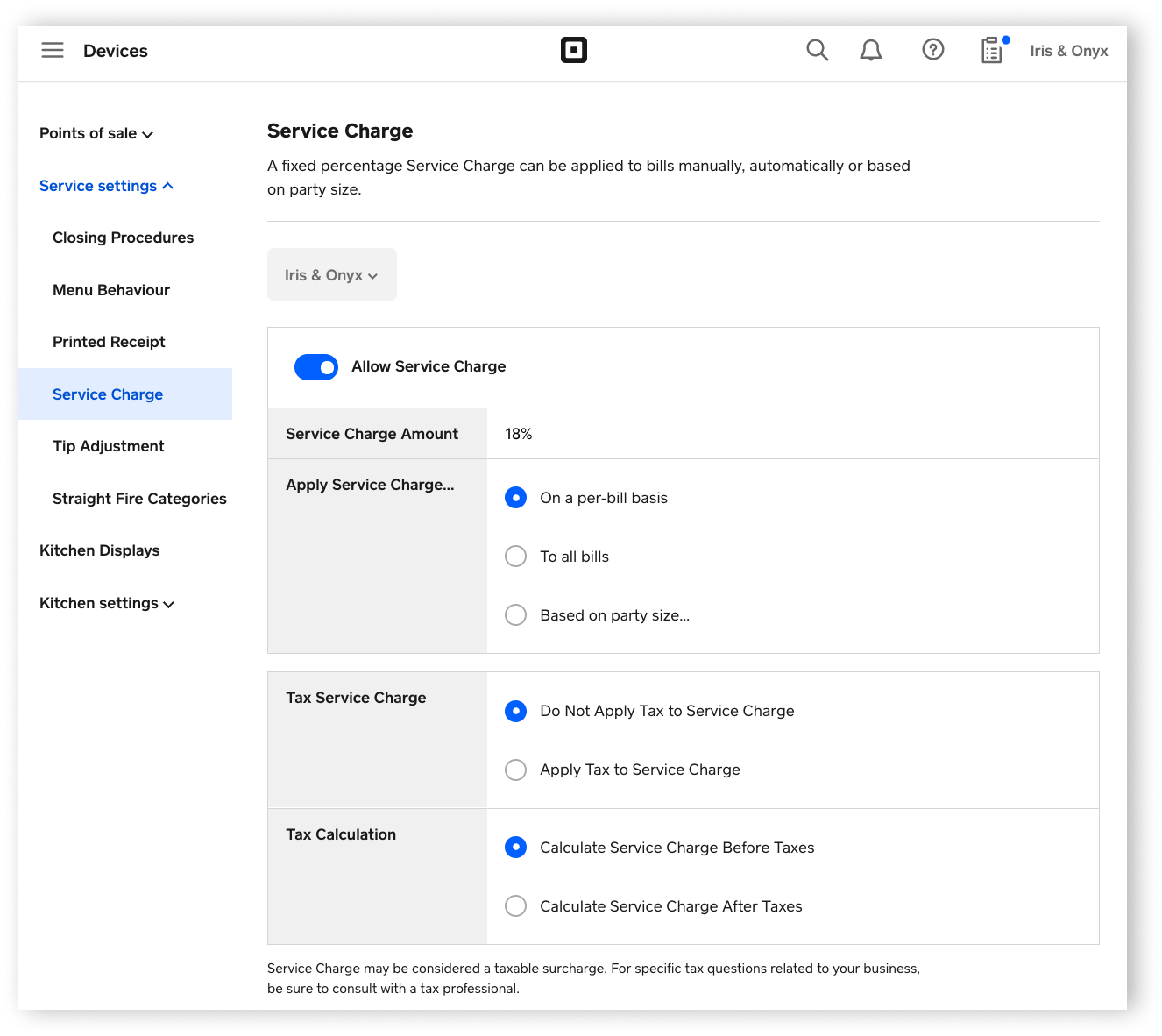

Apply A Service Charge With Square For Restaurants Square Support Centre Au

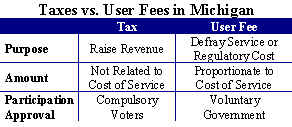

Note To Michigan Municipalities A Tax Is Not A User Fee Mackinac Center

Residential Five Stone Tax Advisers

What Is A Tax Service Fee With Picture

Understanding Tax On Gratuity Vs Service Charge Paychex

Sales Tax Disputes Further Erode Copy Service Fees Scanfiles Inc

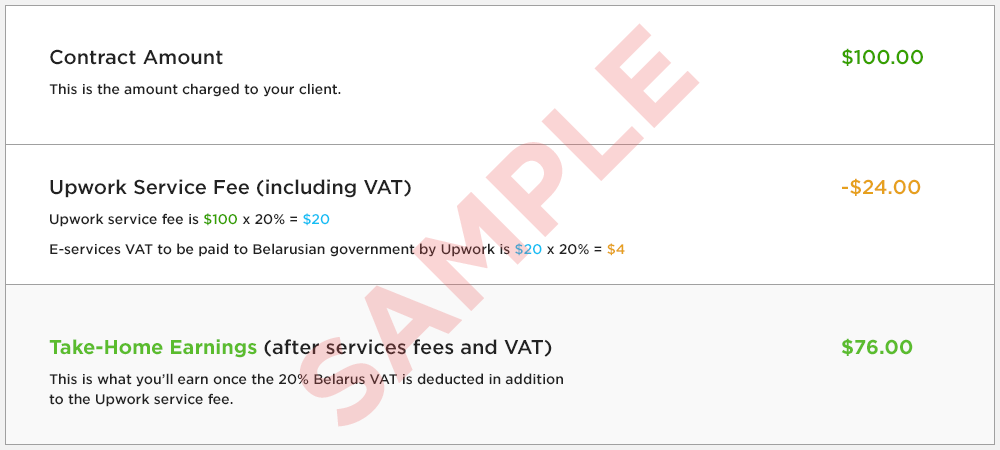

Value Added Tax Vat On Freelancer Fees Upwork Customer Service Support Upwork Help

Do I Charge Sales Tax On Services Paykickstart

Additional Fees Taxes Anyroad Help Center

Do Your Guests Know Who Receives The Service Fee

Local Governments Begin To Measure Effect Of New Illinois Sales Tax Collection Fee The Civic Federation

Current Issues Projects Farm Hill Neighborhood Redwood City

For San Antonio Restaurants Is It Legal To Add Mandatory Service Fee And Alcohol Sales Tax To The Bill See Comments For More Info R Sanantonio

Wellness Fees Service Charges And Automatic Gratuities Oh My Larkin Hoffman Employment Labor Law Blog

Government Taxes Fees At T Community Forums

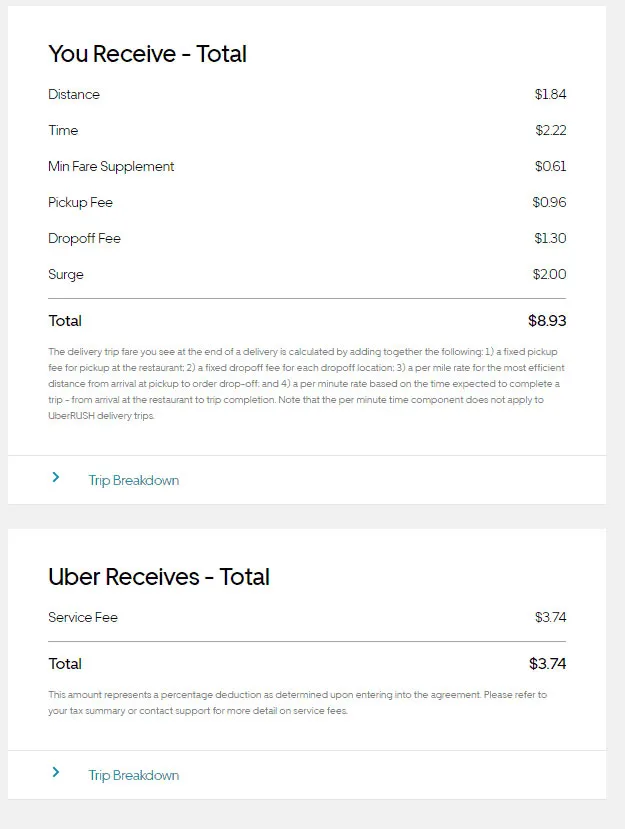

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

Taxation Control Abstract Concept Vector Illustration Set Value Added Tax System Tax Free Service Transportation Surtax Retail Good Purchase Refunding Vat Transit Service Fee Abstract Metaphor Stock Vector Adobe Stock

/cloudfront-us-east-1.images.arcpublishing.com/dmn/WETYC4NWXZGOFBPMKA527TKB2M.png)